Global Properties

As global real estate shifts, Australia has captured the attention of Chinese investors more than ever.

With its stability, growth potential, and quality of life, the Australian property market is emerging as an ideal haven for secure, long-term investment.

But what draws explicitly Chinese buyers to Australia, and what can investors expect?

Here’s a detailed look at why Chinese interest is rising and what it means for the market.

Source: Juwai IQI

Australia’s property market has become a focal point for Chinese investors looking beyond domestic investments to secure stable, appreciating assets overseas.

According to a 2023 survey by Juwai IQI, Australia ranks as the most attractive market globally for Chinese buyers, outpacing Canada and the UK in real estate appeal.

Several factors are driving this trend:

| Factor | Explanation |

| Stability | Australia’s property market offers stability that many investors consider essential, especially amidst volatility in Chinese markets. |

| Quality of Life | Cities like Sydney and Melbourne offer high standards of living that are attractive to investors and their families. |

| Educational Opportunities | Australia’s globally ranked educational institutions are a significant draw for Chinese families seeking housing for student family members. |

Chinese investors find Australian real estate appealing due to differences in market structure and ownership regulations.

Here’s a comparison that highlights why:

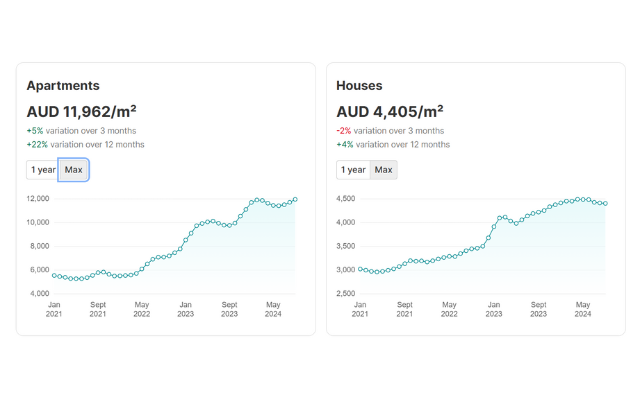

Source: Properstar, average property cost for Australia

Source: CEIC, average property cost for China

| Factor | Australia | China |

| Ownership Type | Freehold (permanent ownership) | Leasehold (up to 70 years) |

| Investment Stability | High, with regulatory solid support | Moderate, with fluctuations in policies |

| Average Property Cost | AUD 4,405/sq m (houses), AUD 11,962/sq m (apartments) | RMB 9,800.239/sq m |

| Rental Yield Potential | 5-8% average | 1.4% average |

| Foreign Ownership Policies | FIRB approval, additional taxes in some states | Restrictions on foreign currency outflow |

Source: Australian Government Department of Foreign Affairs and Trade, Hoole Marketing, PropertyNow, Your Investment Property Magazine, Prime Capital, Statista 2024, CEIC, Your Mortgage, The Business Times, & Properstar, value subject to change

Australia’s regulatory stability and government-backed protections attract Chinese investors seeking reliable capital growth.

Historically, property prices in major Australian cities have seen steady appreciation.

Below are the house prices over the last 10 years in each major Australian city:

| City | Median house price | Growth per annum | Total 10-year growth |

| Sydney | $1,924,710 | 7.0% | 7.1% |

| Melbourne | $1,61,070 | 4.3% | 5.8% |

| Brisbane | $1,104,641 | 14.1% | 7.3% |

| Adelaide | $909.476 | 15.4% | 6.6% |

| Perth | $994,562 | 18.5% | 2.8% |

Source: Michael Yardney’s Property Investment Update & SQM Research, as of June 2024, value subject to change

The opportunity for family relocation also plays a role in real estate interest, especially with Australia’s world-renowned universities and safe environment appealing to Chinese families.

“Australia’s appeal lies in its high quality of life and reputable education system, providing a perfect environment for Chinese families considering long-term investments,” says Peter Li, a Sydney-based real estate expert in Your Investment Property Magazine.

With the Chinese Yuan's strength relative to the Australian dollar, Chinese investors often view Australian properties as being discounted.

As PropertyNow mentioned, this perceived “value” has allowed many to overcome additional taxes imposed on foreign buyers in New South Wales and Victoria.

Non-residents, including Chinese investors, must secure approval from the Foreign Investment Review Board (FIRB) for new dwellings or vacant land purchases to purchase property in Australia.

Specific state policies further impact foreign buyers:

Source: Australian Government & Prime Capital, value and state policies are subject to change.

According to Jonathan Kearns, the RBA’s head of financial stability, in Hoole Marketing, Chinese investors are significant in Australia’s real estate sector, comprising 10-15% of new housing sales and 25% off-the-plan apartments in Sydney and Melbourne.

These investments contribute to both supply and demand:

Due to this demand, areas with high levels of Chinese investment, such as Chatswood and Strathfield in Sydney, have benefited from improved infrastructure and increased property values.

“Chinese investment has historically increased both the value and infrastructure in targeted areas,” says Peter Li in Your Investment Property Magazine.

Chinese buyers employ diverse strategies for acquiring property in Australia, each reflecting a unique investment purpose.

Australia offers a stable market, quality lifestyle, and strong capital growth potential, making it a top destination.

Key benefits include freehold ownership, a stable economic environment, and opportunities for educational investments.

Australia’s market offers freehold ownership and fewer fluctuations, while China operates on a 70-year lease system with economic instability.

Foreign buyers must obtain FIRB approval and may face additional state taxes and vacancy fees.

Yes, they often invest in high-end properties, benefiting from favorable exchange rates and the stability of Australia’s luxury market.

Chinese investment supports new developments and rental availability and drives demand, affecting local prices.

Foreign investors may pay higher stamp duty and land tax surcharges depending on the property's location in Australia.

The rise of Chinese investment in Australia’s property market showcases a mutual interest rooted in economic stability, lifestyle appeal, and long-term growth potential.

By understanding this investment trend's intricacies, investors and industry professionals can better navigate the opportunities and impacts it brings to Australia’s real estate landscape.

Secure your future with Australia’s thriving property market! Invest today for stable growth, prime locations, and unmatched lifestyle benefits. Fill in the form below and start your investment journey with Juwai Asia now!