Global Properties

Ranked as the best country in the world to invest or do business for in 2019, Malaysia is a foreign investor favorite due to its steady economy, geographically benefited areas with easy access, tax-free zones, and more.

Before you commit to purchasing real estate in Malaysia, you must learn about the following:

There is no restriction on the number of properties that a foreigner can own in Malaysia, whether the purpose is of living in or for other investments.

A foreign national can purchase any property in this country!

Malaysian investors have to select from some types of investment according to their requirements, like their own needs, risks, and future aspects.

Cash investments, fixed assets, growth investments, and defensive investments are some investment categories to be chosen from.

There are certain requirements needed to fulfill for foreigners looking for homeownership in Malaysia. The requirements depend on each state. It is recommended to get in touch with the relevant state authorities for further clarification to find out the types of properties that can be purchased.

As per law, the only restricted properties that foreigners can’t own are:

So, there are opportunities to own terraced houses, industrial land, bungalows, commercial property, and more. It is advised to check with the state authorities for confirmation.

Want to invest in Malaysia? Click here

If you are a foreigner and want to buy a property in Malaysia, you would need to understand the scenario of Malaysia’s property market before making any decisions.

So, first and foremost, get some ideas by exploring properties for sale. Browsing is definitely a very good option in today’s tech-friendly world. You can check out juwai.asia, a platform to empower Asians to be global residents.

A form, which is called the developer’s sales form, the offer purchase form, or a Letter of Offer, needs to be signed and submitted.

The form will be given by the seller for sub-sale transactions. It is to show that you are clear about buying a property and agreeing to the upfront payment (usually 2-3%).

If it is necessary, you can apply for a loan. The accessible margin of financing with Malaysian banks will vary depending on your circumstances.

Usually, MM2H provides 80% financing of the total purchase price. It will be at a maximum of around 70% without MM2H. You can also avail an alternative option of sourcing your home loan overseas.

Read more about MM2H here.

You have to provide your lawyer with the relevant documents:

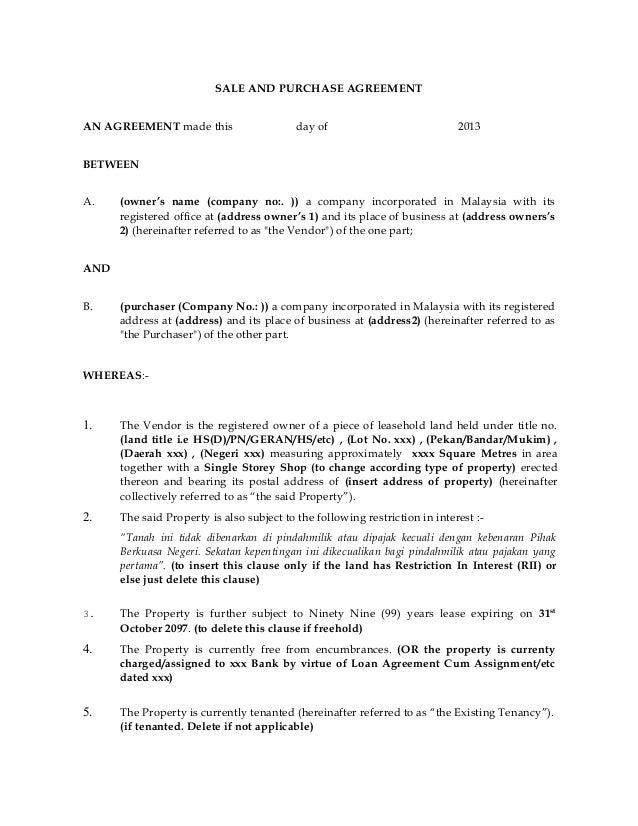

Within a couple of days (usually 14 days) of signing the letter of offer, a Sale and Purchase Agreement (SPA) needs to be signed.

SPA covers all the terms and conditions of the sale. This phase includes a 10% down payment.

The 2-3% you have previously paid during the initial steps contributes towards this 10% deposit total.

At this stage, you may also have to come across mutual covenants (if needed) and other transactional documents.

Sample sub-sale SPA from company to company. Image credits: Slideshare

When the agreement is made, your legal executive will then ask for final state authority consent. This consent is necessary since you have to ensure your property fulfills the noted requirements by the state prior to this point.

You have to provide some other documents in the meantime. The documents include –

In this step, you have to pay the remaining balance of 90% as per the property purchase price.

It is explained under the SPA, or Schedule H Housing Development (Control And Licensing) (Amendment) Regulations 2015.

At last, the developer will deliver the vacant property at the announced date.

For individual titles, it will be done within 24 months. It will take 36 months for strata title properties under development.

The transfer date is based on the negotiated time frame in accordance with the SPA and the signing of the Memorandum of Transfer in sub-sale/secondary market purchases.

Let the professionals take care of every step of the process. Contact us now.

In general, a minimum value of RM1 million is applied to all kinds of property in almost every state of Malaysia.

Nevertheless, the government has lowered the price level for foreign property ownership from RM1 million to RM600k in urban areas that began in January 2020. *This is only applicable to unsold units and remaining stock in the condominium and apartment categories.

However, there are exceptions for four states – Penang, Selangor, Negeri Sembilan, and Sabah. These states’ authorities remain in power to revise the minimum value.

Penang's Minimum Purchase Price

| Island | Mainland | |

| Stratified properties | RM800,000 | RM400,000 |

| Landed properties | RM1.8 million | RM750,000 |

Selangor's Minimum Purchase Price

Strata properties (including strata landed homes): RM1.5 million

Negeri Sembilan's Minimum Purchase Price

| Landed home (included landed strata) | RM1 million |

| High-rise strata property | Exceeding RM600,000 |

Sabah's Minimum Purchase Price

Overhang residential properties: RM750,0000

Source: iProperty

Owning a property as a foreigner will be a completely new ride, and engaging with a real estate agent will definitely quicken the process without a hassle.

Leave your details below for our seasoned agents to reach out and assist you!