全球樓盤

Prior to the onset of the COVID-19 pandemic, Dubai ’s property market had started to show early signs of a sustained recovery in demand. Transaction volumes began registering significant annual growth rates since June 2019 and this strong momentum continued into the start of the new decade. In the year to February 2020, transaction volumes increased by 24% compared to the same period a year earlier, making it the strongest start to the year the market had witnessed since 2017.

However, since then, activity has slowed considerably as Dubai, and indeed the wider UAE, enacted a range of measures to control the spread of the pandemic. Within the UAE, Dubai had enacted some of the strictest containment measures including 24-hour lockdowns for the majority of April. Considering the severity of these measures, activity in Dubai’s residential property market had not come to a complete halt. Whilst transaction activity has certainly slowed, the depth of the contraction has been relatively limited. In the year to June 2020, transaction volumes have decreased by 14.4% compared to the same period a year earlier. Over this period, off-plan and ready transaction volumes fell by 14.0% and 14.9% respectively.

During the lockdown period, off-plan transaction volumes had been supported by the relative ease of transacting off-plan property and as a result of many developers reacting remarkably quick in introducing virtual client viewings. The process of buying a ready residential unit is more complex from both a documentation perspective and a buyer’s preference to physically view the property, something that had not been possible during the lockdown. Click to View Dubai Property for Sale

Looking ahead, given the economic impact that COVID-19 has had and will continue to have over the course of the year, we can expect that demand will taper down from the levels witnessed in 2019.

Average prices, which fell on average by 5.6% in the year to May 2020, are likely to remain under considerable pressure, as a result of demand softening and the influx of supply expected in 2020. In the year to June 2020, almost 8,500 units have been delivered and over 43,000 units are scheduled for delivery over the remainder of the year. Whilst the vast majority of supply additions will be apartments, the supply of villa properties is expected to increase by almost 28,000 by 2022, a substantial increase on current stock levels. As a result, average villa prices, which fell by 9.2% in the 12 months to May 2020, are expected to remain under considerable pressure going forward.

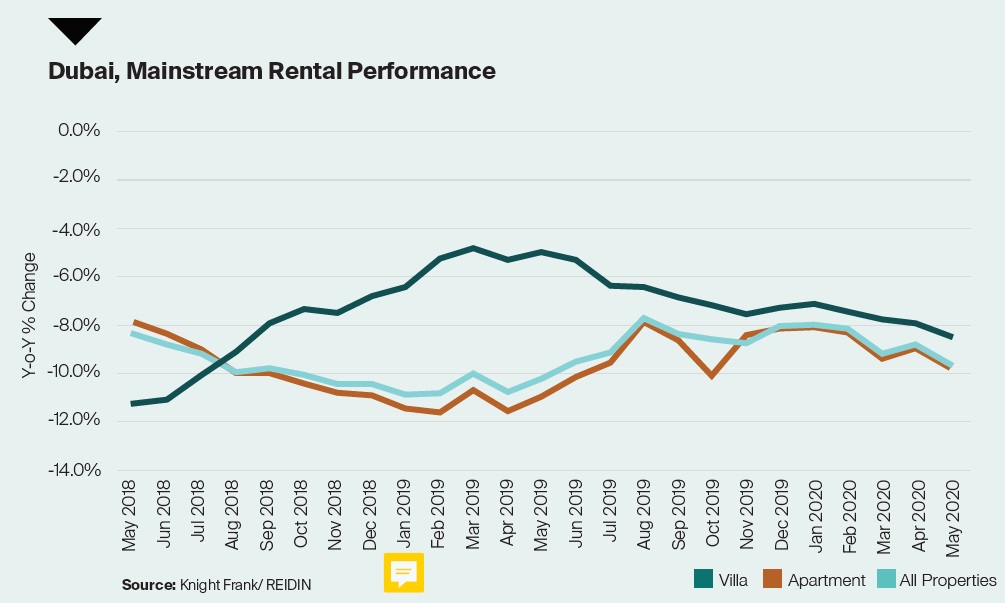

As supply increases and demand wanes as a result of the weaker economic backdrop, rental rates, which fell by 9.8% in the year to May 2020, are likely to continue to soften significantly throughout 2020. More so, landlords will likely become more flexible in relation to payment terms and incentives such as rent-free periods and deposit requirements to secure and retain tenants.

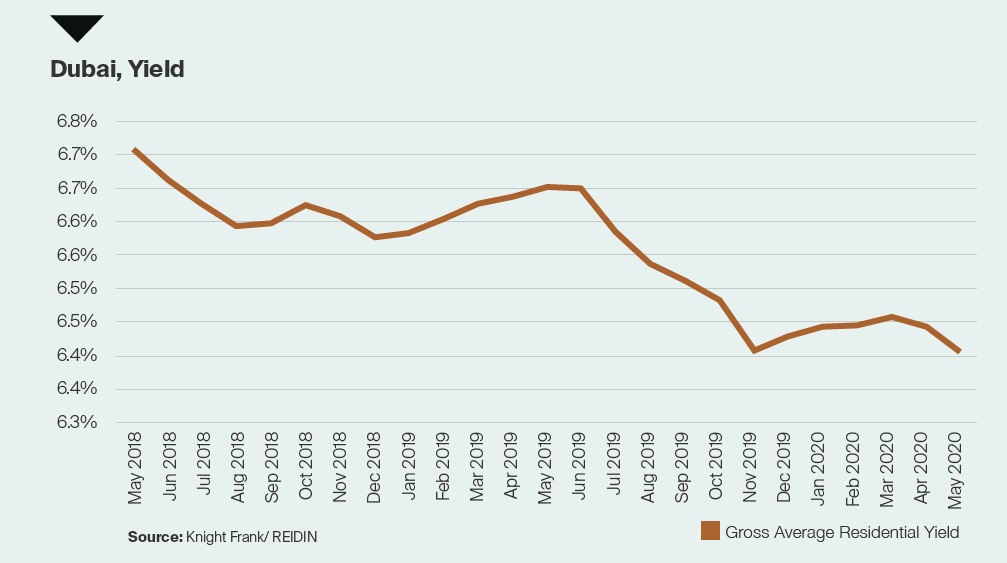

As at May 2020, average gross yields in Dubai ’s mainstream property market registered on average at 6.4%, down from 6.7% a year earlier.

Source: Knight Frank