全球樓盤

Buying a home is considered a dream come true for most people but you should also remember that it is a huge commitment to have. The repayment of your home takes up to 35 years, thus it is crucial that you protect your investment in the event that you are no longer able to service the loan. This is how mortgage insurance comes into play.

There are two types of mortgage life insurance available in Malaysia to protect your investment which are Mortgage Reducing Term Assurance (MRTA) and Mortgage Level Term Assurance (MLTA).

MRTA is an insurance plan with decreasing sum assured over time that will cover your outstanding home loan or mortgage owed to the bank. This plan is usually offered by the bank you are getting the mortgage from, as it is used as protection for the bank in the event of death or total permanent disability (TPD) that stop you from servicing the loan.

To the contrary, MLTA is a slight variation from MRTA and it is an option for a borrower who is looking for a life insurance which offers extra security plus savings and in some policies returns on the premium.

When you are no longer around or do not have the ability to generate income, a mortgage insurance policy frees the borrower’s dependents from any debt as the insurance company will pay off the remaining debt on repayment mortgages.

Thus, allowing your spouse or beneficiaries to continue staying in the property debt-free without having to worry about settling the house loan.

Here are the some important differences between MRTA and MLTA to help you decide on which insurance you should get.

Applying for the MRTA is more suitable for those who do not have many dependents relying on them financially and have adequate life as well as medical insurance. If you do not have any other insurance, then it would be advisable to get the MLTA policy.

MRTA will service your home loan if it has not been fully repaid in the event of death or TPD. Your family members will not get any money from the policy as the beneficiary is the bank, not your family members.

On the other hand, if you do have many financial dependents including your children or stay-at-home spouse and you are looking for extra financial protection, then MLTA is the best plan for you as it has a cash value at the end of the policy.

MRTA is better suited for people who are buying a property for long-term use as it is not easy to transfer the insurance if you do plan to sell your house. Whereas, MLTA can be transferred, making it ideal for investment properties.

It is important to take into consideration that you will be able to pay the premiums for an MLTA policy throughout the duration of the loan. If it is a challenge for you to service monthly or annual premiums, it’s better to go with the MRTA insurance.

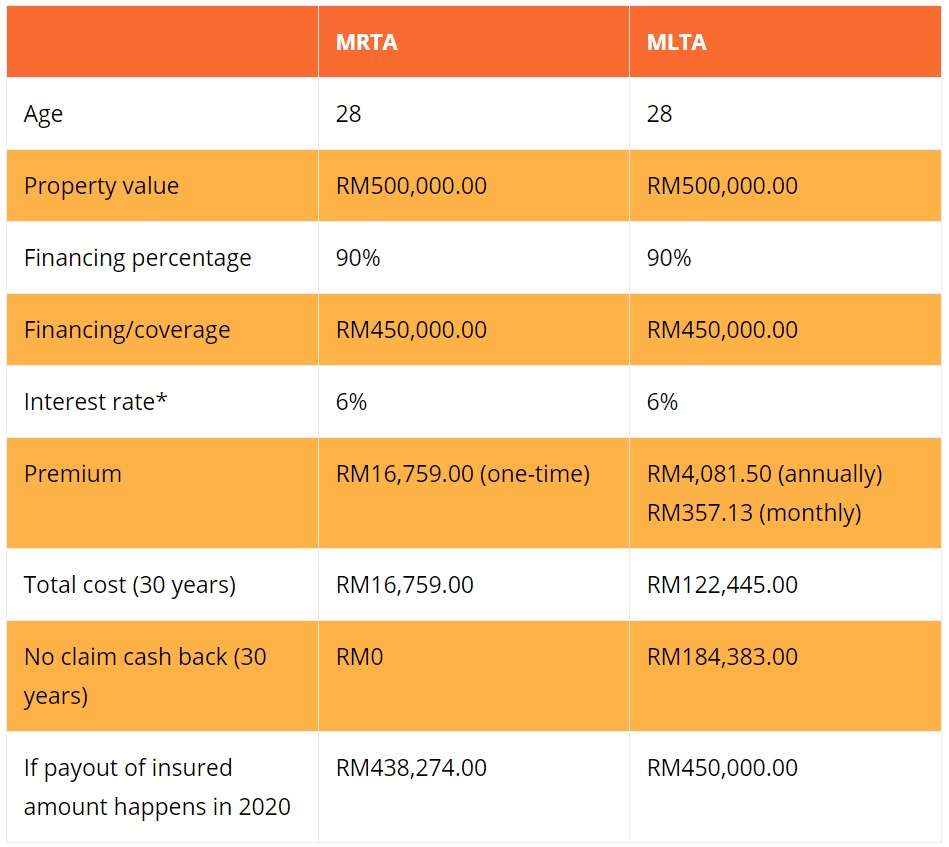

Now that we have learned the differences between MRTA and MLTA insurance plan. Below is the comparison of the estimated payout between MRTA and MLTA based on insurance cover for the sum of RM450,000 using 6% interest over 30 years starting in 2018 for a 28-year-old homeowner:

* These figures are used as reference as the interest rate will be different from one insurer to another; refer to your original policy for the actual terms.

Bank Negara Malaysia (BNM) doesn’t require homebuyers to purchase mortgage insurance, however many financial institutions are unlikely to lend to a home buyer if he doesn’t subscribe to a policy.

Now that you’ve learned the differences between these two insurance plans, you could make the right better decision for you and your family. However, if you’re still unclear on which plans to pick, our real estate professionals could lead you in the right direction. Leave your details in the form below to get in touch with our team of experts.

Source: IQI Global Blog