Global Properties

Ever heard that the Malaysian Ringgit is on a roller coaster ride in 2025 and felt a bit lost in the headlines?

You see terms like "de-dollarisation" and "fiscal policy" and wonder what they all really mean for your wallet or travel plans.

Don't worry, we're here to break it all down. Let's unravel the mystery of the Ringgit's rally in simple, easy-to-understand terms.

Key Takeaways:

The Malaysian Ringgit is strengthening, mainly due to a weaker US dollar and a growing global trend of de-dollarisation.

Strong domestic factors, including a stable economy, government reforms, and a steady trade surplus, are providing a solid foundation for the Ringgit's performance.

Analysts forecast the Ringgit to trade in a stronger range, with year-end predictions hovering between RM4.08 and RM4.15 against the US dollar.

Regionally, the Ringgit is among Asia's top-performing currencies, alongside the Singapore Dollar and South Korean Won, reflecting a broader shift of investor interest into Asia.

Is the Malaysian Ringgit Rising or Falling in the Future?

|

The biggest reason the Malaysian Ringgit feels so muscular this year has less to do with Malaysia itself and more to do with the big player on the block: the US dollar.

For decades, the US dollar has been the world's go-to currency. But in 2025, that's changing fast.

This big shift is called de-dollarisation. Sounds complicated, right? It's not.

Let me give you an example: think of it like the most popular lunch spot in a food court, suddenly getting more expensive and less reliable.

All the customers who used to go there every single day would start trying out other stalls, right? That’s exactly what’s happening with the US dollar.

Countries around the world, especially major economies like China and its trading partners, are looking for alternatives.

Why? Analysts from Rakuten Trade point to some big concerns.

The US national debt has exploded to over US$37 trillion, making some investors nervous about its long-term stability.

Source: The Malaysian Reserve

As Kenny Yee Shen Pin, Rakuten's head of research, put it, "Global de-dollarisation has been in the works for years, but the difference now is the presence of a major economic power like China leading the charge."

This creates a ripple effect. When the main currency everyone uses (the US dollar) weakens, other currencies like the Malaysian Ringgit naturally get a boost.

It’s a bit like a seesaw; when one side goes down, the other goes up.

While the weakening US dollar gives the Ringgit a major tailwind, Malaysia has also been doing its homework, making its own economy strong and attractive.

It’s a story of getting your house in order at just the right time.

First off, Malaysia’s economy is proving its economic resilience.

While bigger economies are worried about recessions, Bank Negara Malaysia (BNM), the country's central bank, projects Malaysia’s economy to grow between a healthy 4% and 4.8% in 2025.

This steady growth, along with low inflation, creates a stable environment that investors love.

The Malaysian government, under its Ekonomi MADANI framework, has rolled out some key MADANI government reforms aimed at strengthening the country for the long haul.

They've introduced tax incentives to attract high-tech companies in sectors like semiconductors and renewable energy.

This not only creates better jobs but also diversifies the country's income streams, making it less dependent on any single industry.

This thoughtful planning has boosted investor confidence, with foreign direct investment (FDI) and portfolio inflows on the rise.

Bank Negara Malaysia (BNM) has been playing its cards smartly.

Instead of making drastic moves, it has taken a measured approach to monetary policy.

For most of the year, it kept its key interest rate (the OPR) stable before making a small, calculated cut in July to 2.75% to support growth.

BNM has also been encouraging Malaysian exporters to bring their foreign earnings back home and convert them into Ringgit.

A report in The Straits Times highlighted just how big an impact this could have, noting that Malaysian companies hold a massive amount of foreign currency deposits.

When that money comes back home, it creates a massive demand for the Ringgit, pushing its value up.

The Ringgit’s strong performance isn't happening in a vacuum.

In fact, 2025 is shaping up to be a big year for many Asian currencies as global investors shift their attention to the region's dynamic economies and emerging markets.

So, how does the Ringgit compare to its neighbors?

Here's a look at some of the strongest currencies in Asia for 2025, which gives a clearer picture of the regional trend.

| Rank | Currency | Code | Approx. Rate (1 USD) | Key Strength |

| 1 | Singapore Dollar | SGD | 1.29 | Financial Stability, Strong Trade |

| 2 | Japanese Yen | JPY | 148.6 | Safe-Haven, Deep Capital Markets |

| 3 | South Korean Won | KRW | 1,390 | Tech Exports (Semiconductors) |

| 4 | Taiwan Dollar | TWD | 29.43 | Global Tech Industry Leader |

| 5 | Indian Rupee | INR | 85.97 | Strong Domestic Consumption, Services |

| 6 | Chinese Yuan | CNY | 7.18 | Government Stimulus, Trade Surplus |

| 7 | Hong Kong Dollar | HKD | 7.85 | Pegged to USD, Financial Hub |

| 8 | Malaysian Ringgit | MYR | 4.25 | Commodity Prices, FDI, Stability |

| 9 | Thai Baht | THB | 32.48 | Tourism Recovery, Fiscal Discipline |

| 10 | Philippine Peso | PHP | 57.19 | Overseas Remittances, BPO Industry |

Source: XS.com

As you can see, the Malaysian Ringgit is firmly placed among the region's heavy hitters. Its strength is built on a mix of positive factors, from recovering commodity prices for things like palm oil to the increasing flow of foreign investment into its growing tech and green energy sectors.

So, we know why the Ringgit is getting stronger. But how high could it go?

Analysts and investment banks have been crunching the numbers, and while the exact figures vary, the overall market sentiment is bullish.

Before we look at the forecasts, let’s look at what's happening under the hood of Malaysia’s export economy.

Source: XTransfer

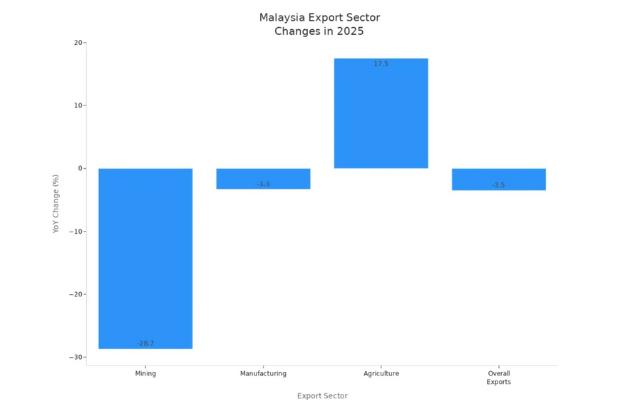

Based on this chart of Malaysia's export sectors in 2025, we can see a fascinating shift.

Let's do a quick analysis of that chart.

For example, while Malaysia’s Mining exports saw a sharp drop of 28.7%, the Agriculture sector shot up by a massive 17.5%.

This tells us that even if one part of the economy faces headwinds, another part can surge forward, contributing to the overall resilience we discussed.

This diversity is a key part of the Ringgit's strength.

Now, let's see what the experts are predicting for the Ringgit forecast at the end of 2025.

| Institution | Year-End 2025 Forecast (USD/MYR) | Key Justification |

| Kenanga Investment Bank | 4.08 | Accelerating global de-dollarisation and strong domestic fundamentals. |

| HLIB Research | 4.10 | Shift in global sentiment and renewed foreign capital inflows into Malaysia. |

| SPI Asset Management (S. Innes) | 4.10 - 4.15 | Primarily driven by broad weakness in the US dollar. |

| MIDF Research (MBSB) | 4.30 (Average) | Narrowing interest rate differentials as the US Fed is expected to cut rates. |

Source: Kenanga, The Malaysian Reserve, NST Online & MBSB Research

Of course, no forecast is guaranteed. HLIB Research and other analysts warn of potential risks.

A stronger Ringgit makes Malaysian exports more expensive, which could hurt companies that sell goods overseas.

There’s also the wild card of US trade policy—if new, broad tariffs are introduced, it could disrupt global trade and throw a wrench in the works.

Okay, let's bring this all down to earth. Economic news is interesting, but what you really want to know is how it affects your daily life.

A stronger Ringgit has some very real-world consequences.

This is the most straightforward benefit. Let's use a simple example.

Let’s say you’ve been eyeing a new gadget online that costs US$100.

When the exchange rate was RM4.80 to US$1, that gadget cost you RM480.

Now, with the rate at RM4.20, that same US$100 gadget costs you only RM420.

That’s a savings of RM60! A stronger Ringgit gives you more purchasing power abroad and online. Your holiday in Japan or the US just got a little cheaper, thanks to favorable currency exchange.

Here, it depends on which side of the trade coin you're on.

Importers are cheering. If your business imports raw materials or products, say, coffee beans from Brazil or machine parts from Germany, a stronger Ringgit is fantastic. You pay fewer Ringgit for the same amount of foreign goods, which lowers your costs and can boost your profits.

Exporters face a challenge. Suppose your business sells products overseas, like furniture or electronics. A strong Ringgit makes your goods more expensive for foreign buyers. This could make you less competitive compared to sellers from countries with weaker currencies.

Have you noticed that prices for some imported goods at the supermarket haven't been climbing as fast as you'd feared?

You can thank the stronger Ringgit for that. Malaysia imports many goods, from food items to consumer electronics.

When the Ringgit is strong, the cost of importing these items is lower, which helps keep a lid on domestic inflation and eases the cost of living.

The Malaysian Ringgit's impressive rally in 2025 isn't a fluke. It's the result of a "perfect storm" of positive factors.

A shifting global landscape is causing the once-mighty US dollar to lose some of its shine, while on the home front, Malaysia's steady economic management, political stability, and forward-thinking reforms are attracting global attention and investment.

While it’s always wise to keep an eye on potential global risks, the foundation for the Ringgit’s strength appears solid.

By staying informed, you can better understand the forces shaping your currency and what it means for your financial well-being.

"It won't be a clean glide path," but "the direction is clear," as analyst Stephen Innes wisely said in NST Online.

Most analysts believe the Ringgit has more room to appreciate through 2025, with forecasts ranging from RM4.08 to RM4.15 per US dollar. The main drivers are the expected weakness in the US dollar and Malaysia’s strong economic fundamentals. However, any sudden changes in global trade policies or geopolitics could alter this trend.

It's a double-edged sword. A strong Ringgit is good because it lowers the cost of imports, which helps control inflation and makes overseas travel and shopping cheaper for Malaysians. On the other hand, it can be bad for exporters, as their goods become more expensive for foreign buyers, potentially reducing their international competitiveness.

De-dollarisation is the global trend of countries gradually reducing their reliance on the US dollar for international trade and as a reserve currency. Instead of using US dollars to pay for everything, countries are increasingly using their own local currencies for trade deals. This reduces demand for the US dollar and strengthens other currencies like the Ringgit.

Bank Negara Malaysia (BNM) plays a crucial role by ensuring financial stability. They have managed monetary policy cautiously, keeping interest rates steady to support growth without fueling inflation. As mentioned in the official FAQ on Ringgit document, BNM does not target a specific exchange rate level but acts to prevent sudden, large swings to ensure the market is orderly. Their policies help build investor confidence, which supports the Ringgit's value.

Not necessarily. According to Bank Negara Malaysia's FAQ, the Ringgit's value against the US dollar alone is not a full reflection of the economy's health. It’s more important to look at its value against a basket of currencies of Malaysia's major trading partners, known as the Nominal Effective Exchange Rate (NEER). The Ringgit could be falling against a strong US dollar but rising against other currencies at the same time.

No, most experts, including BNM, agree that a peg is no longer suitable for Malaysia's modern, open economy. Pegging the Ringgit would mean Malaysia loses control over its own monetary policy and would have to follow the US Federal Reserve's interest rate decisions, even if it's not right for Malaysia's economy. The current floating exchange rate system acts as a better shock absorber for the economy.

The biggest risk cited by multiple analysts is a potential shift in US trade policy, such as the re-introduction of wide-ranging "Trump-era" tariffs. Such a move could disrupt global trade, slow down world economic growth, and cause investors to rush back to the safety of the US dollar, which would weaken the Ringgit and other regional currencies.

With the powerful Ringgit, your investment goes further in Malaysia's property market. Seize this golden opportunity! Explore exclusive listings and start building your real estate portfolio with Juwai Asia today. Contact us now!

Reference and Citation